Enjoy the Seamless Instant Fund Transfers with LankaPay CEFTS

Experience the convenience of real-time fund transfers with LankaPay CEFTS and take control of your finances like never before! Our Common Electronic Fund Transfer Switch (CEFTS) allows you to transfer funds in real-time, up to Rs.5 Mn, conveniently and securely from anywhere, any time.

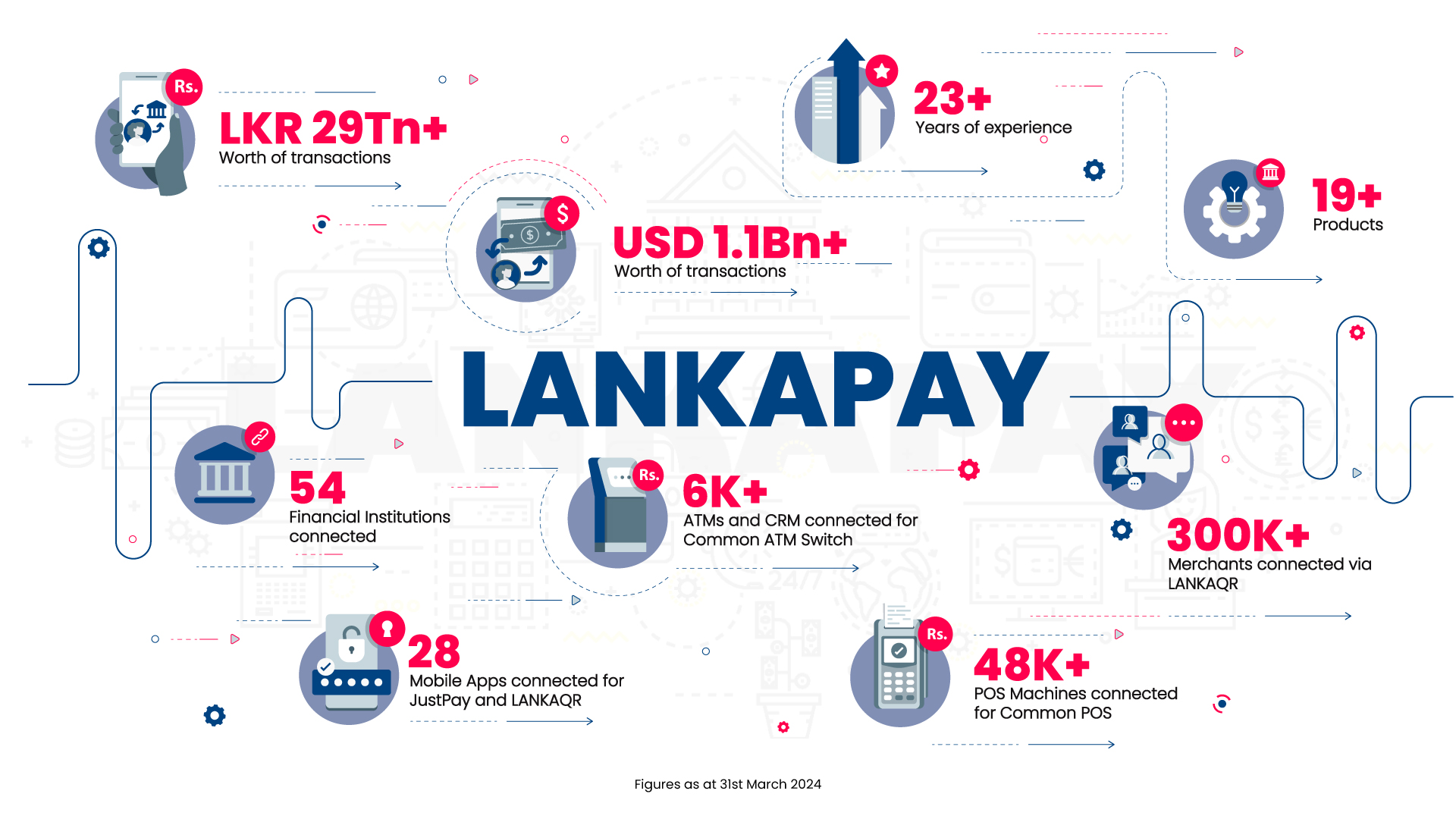

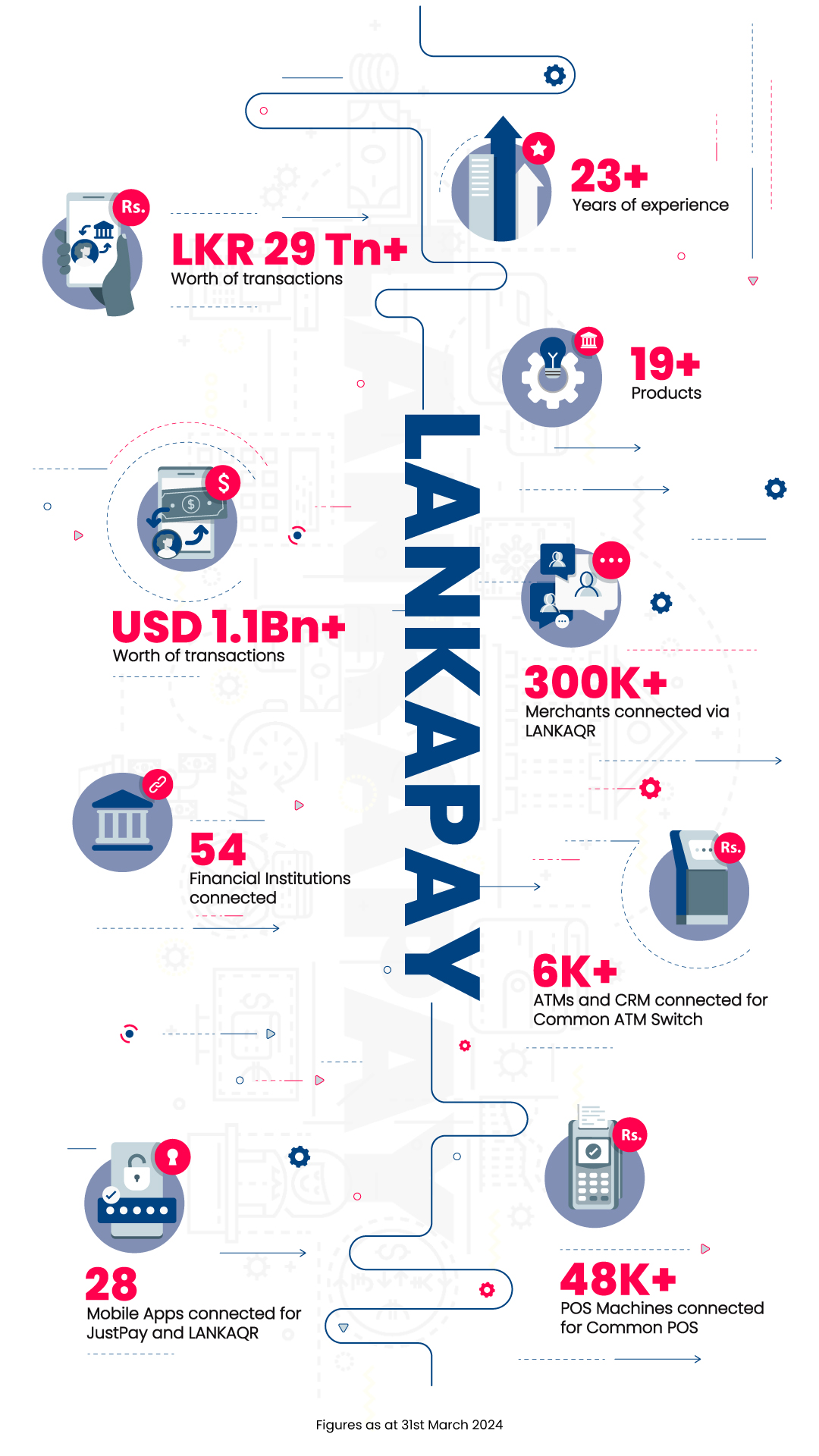

Revolutionizing Digital Payments

in Sri Lanka

Experience the convenience of making day-to-day payments securely, conveniently in real-time with JustPay, empowering seamless transactions and contributing to Sri Lanka's cashless economy.

Withdraw Your Cash From Any ATM

Enhancing Access to Banking Services

Explore the convenience of accessing your account from any ATM across Sri Lanka with LankaPay Common ATM Network.

Your Link to Send and Receive Funds Instantly

Experience the ease of requesting and sending funds in a flash with PayME - revolutionary payment solution designed to cater to peer to peer and corporate payment requests.

.jpg)